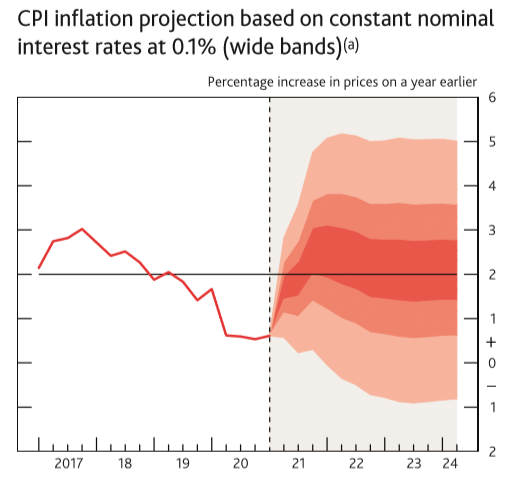

Twelve-month CPI inflation rose from 0.4% in February to 0.7% in March which is well below the medium-term 2% inflationary target that would trigger any pressure for an interest rate rise.

However, the news is not all bad for the UK with the Bank of England expecting GDP to have fallen by around 1½% in 2021 Q1 This is less weak than was assumed in the February Report.

With new Covid cases continuing to fall, the vaccination programme, and restrictions on economic activity are easing GDP is expected to rise sharply in 2021 Q2, although activity in that quarter is likely to remain on average around 5% below its level in 2019 Q4.

GDP is expected to recover strongly to pre-Covid levels over the remainder of this year in the absence of most restrictions on domestic economic activity. Consumer spending is also supported by households running down over the next three years around 10% of their additional accumulated savings. After 2021, the pace of GDP growth is expected to slow as the boost from some of those factors wanes.

The MPC indicated: “The outlook for the economy, and particularly the relative movement in demand and supply, remains uncertain. It continues to depend on the evolution of the pandemic, measures taken to protect public health, and how households, businesses and financial markets respond to these developments.

And they will: “Continue to monitor the situation closely and will take whatever action is necessary to achieve its remit. The Committee does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably.”