Zoopla is hoping pre-existing slower house price growth and tougher mortgage regulations will mean this recession is different to the past.

Analysis by the portal said it does not foresee a major decline in UK house prices as a result of the recession.

It said this was because price growth is already low, mortgage lending criteria has been tightened since the financial crisis and unemployment may be concentrated among younger age bands who rent rather than own a property.

Zoopla’s figures shows properties are selling faster, with the number of days to reach the sold subject to contract phase in the past three months hitting 27 days compared with 39 last year.

Three-bedroom houses remain the fastest selling property on the market, with an average time to sell of 24 days since the lockdown lifted, Zoopla said.

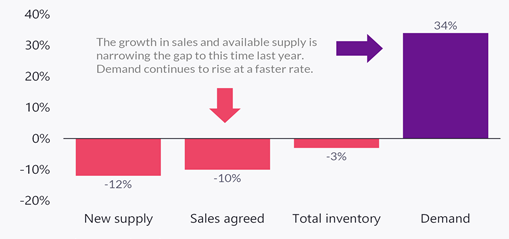

The flow of new supply is running 54% ahead of this time last year, but overall stock per agent remains 3% lower, the portal’s research found.

Zoopla said average UK annual house price growth was 2.5% in July at £253,600.

Richard Donnell, research and insight director of Zoopla, predicted average house prices would end this year up 2% to 3%.

He said: “Housing market conditions remain unseasonably strong despite the UK moving into recession.

“Demand continues to outpace supply and support house price growth of 2.5% per annum.

“Meanwhile, houses are selling faster than flats as we see a shift in buyer priorities in the wake of the lockdown and movers prioritise more space.

“While the economy has contracted sharply and unemployment is rising, consumer spending has rebounded and purchasing manager indices are pointing to a wider rebound in the economy.

“This is positive but the unwinding of the furlough scheme and other Government support is the next challenge that will test the strength of economic recovery.

“In the short term we still believe that house prices will end the year 2% to 3% higher than at the start.”